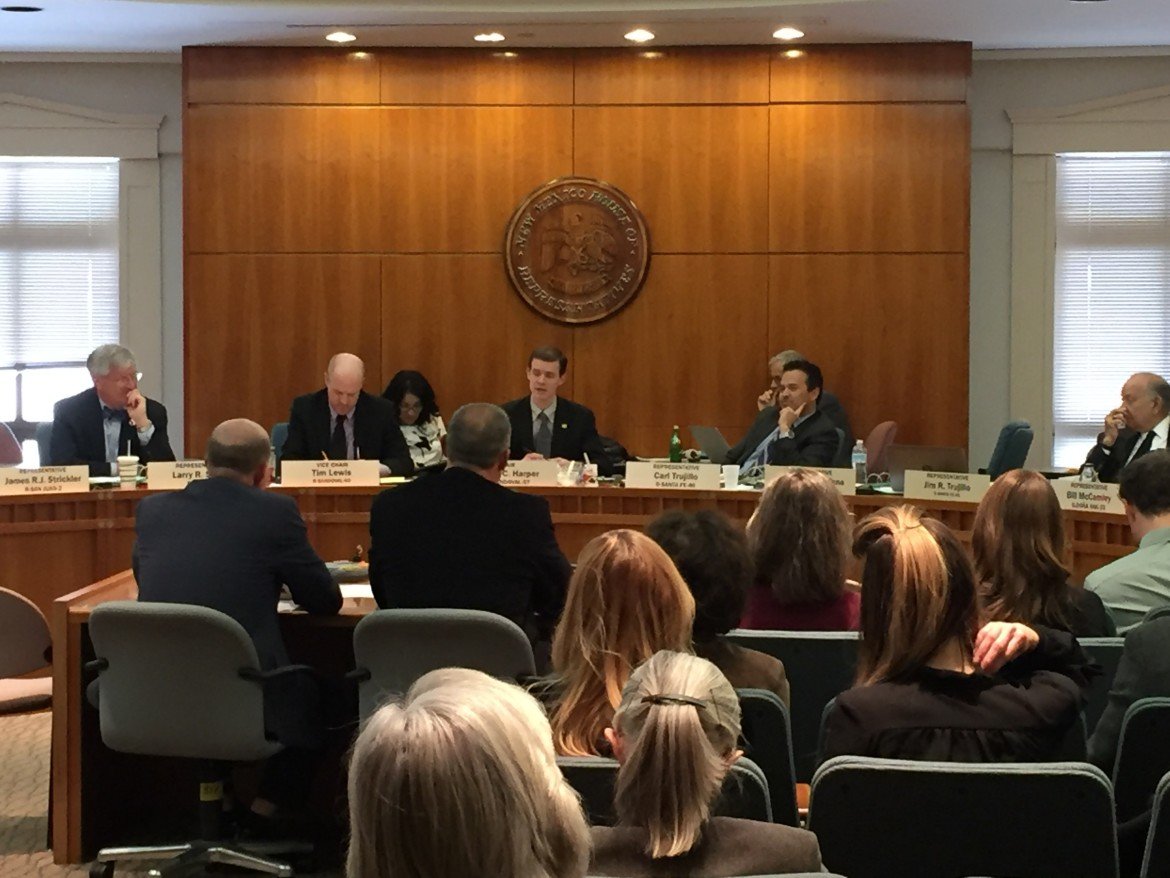

Rep. James Strickler presents HB 107 before the House Ways and Means Committee

We’ve all heard about how low oil and natural gas prices are hurting New Mexico’s state budget. Now, some legislators are trying to move bills through the New Mexico State Legislature that would give greater tax relief to the industry.

Introduced by Sen. Gay G. Kernan, R-Hobbs, SB 34 would amend the state’s Oil and Gas Severance Tax Act to give a break to companies operating wells that use carbon dioxide to separate the oil and natural gas at or near the wellhead.

If passed, the bill will reduce the amount of severance tax they pay the state when the price of oil is below $60 dollars a barrel. In January, the price of oil fell below $30 a barrel.

HB 285, introduced by House Majority Floor Leader Rep. Nate Gentry, R-Albuquerque, is SB 34’s duplicate bill.

According to its fiscal impact report:

Currently, the (Oil and Gas Severance Tax ) Act provides for a 50 percent reduction in the severance tax from 3.75 percent to 1.875 percent for all enhanced oil recovery projects when the posted price of crude oil for the prior year ending May 31 averages less than $28 dollars per barrel. HB 285 would allow the 50 percent reduction for enhanced oil recovery projects that use carbon dioxide when the price averaged less than $60 a barrel for the prior year.

According to the report, New Mexico has seven active enhanced oil recovery projects—that include more than 700 wells—that inject carbon dioxide. In comparison, there are more than 350 recovery projects that inject water. Some of those could be converted to carbon dioxide injection projects in the future.

HB 107, introduced by Rep. James R.J. Strickler, R-Farmington, would also give operators of certain wells a tax break.

Strickler, a “petroleum landman,” owns JMJ Land and Minerals Company.

That bill would change Severance Tax and Emergency School Tax rates for oil and gas wells that produce fewer than ten barrels of oil or 60,000 cubic feet of natural each day. (These are called marginal, or “stripper” wells.)

According to the fiscal impact report, the changes in tax payments would be dependent upon the price of oil and natural gas.

The bill is supported by the state’s Energy, Minerals, and Natural Resources Department and the State Land Office. According to the fiscal impact report, both state agencies say the lower tax rate would motivate companies to continue running the wells instead of capping them.

“Once a stripper well is plugged, the costs of re-entering the well may make future production from the well unlikely,” reads the report. “According to the State Land Office, this bill could increase the money going into the State’s General Fund by encouraging stripper wells to remain active.”

For NMID’s recent coverage of New Mexico’s energy and economy, visit our special project, At the Precipice: New Mexico’s Changing Climate.