Alcohol

Alcohol taxes across country are “very, very low”

|

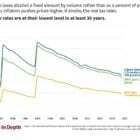

Lawmakers shouldn’t read too much into the fact that New Mexico has some of the highest alcohol taxes in the country, a national expert told them today. Because “alcohol taxes across the country are very, very low.”And Richard Auxier, Senior Policy Associate, Urban-Brookings Tax Policy Center, gave lawmakers at the Legislature’s Revenue Stabilization & Tax Policy Committee hearing a clear answer to questions about whether raising taxes helps improve public health. Yes, he said, research shows that raising taxes reduces consumption and improves health. In the state that leads the country in alcohol deaths, that’s important. But when you get into the weeds of tax policy, everything becomes complicated. Lawmakers should start with understanding their ultimate goal, Auxier said. Is it to eliminate or drastically reduce consumption of alcohol? If so, it might make sense to increase taxes significantly. Or is it to improve public health while not making drinking alcohol so expensive that it becomes out of reach?