Alcohol

Lawmakers water down alcohol proposals amid public health crisis

|

ALBUQUERQUE, NEW MEXICO – JUNE 26, 2022: The alcohol department at a grocery store Albuquerque, NM on June 26, 2022. CREDIT: Adria Malcolm for New Mexico In Depth

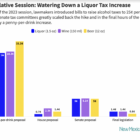

The alcohol industry notched a victory Saturday as the Legislature approved an alcohol tax hike of less than a penny-a-drink on beer and hardly more than that for liquor and wine, a fraction of the 18- to 20-cents public health advocates pushed for in this year’s session.

Lawmakers also rejected a $5 million request from the Department of Health for a new Office of Alcohol Prevention, despite the state’s historic budget surplus. A DOH spokesperson said its epidemiology division would create a smaller version of the office anyway, using an additional $2 million lawmakers added to the agency’s budget.

Public health experts say the tax increase is so small that it’s unlikely to have any effect on excess drinking, let alone tackle New Mexico’s worst–in-the-nation rate of alcohol-related deaths. The chair of the House tax committee, Rep. Derrick Lente, D-Sandia Pueblo, who had rejected a compromise 5¢-per-drink proposal passed by his counterparts in the Senate, acknowledged the final increase was minor on the floor of the House of Representatives on Saturday morning. “If we want to call it minimal, we can call it minimal,” he said.